Thirteen pages. Are we on our knees, yet?

I wouldn't want them to change the laws, but the unions have too much power, to reap havoc within our country.

I am sure you remember that between the unions and the rising fuel prices the country took some major collateral damage in the 70s.

We are heading that way.

Of course as predicted the teachers are piling in now.

If the union can't show some restraint then perhaps the laws should be changed, you can't bring the whole country down just because you have a few gobby power-driven union leaders trying to make a show.

what? everyone's lieing to make their side look better? shocking.

i've seen some details flying around, looks like linked above. harsh new conditions that no one would agree and a sus "fire and re-hire" which is usually ploy at the end of failed negotiations. the workforce would all go contracting instead, maybe thats the plan.

This will cause an avalanche of wage demands at a time when we are so vulnerable.

We are coming off the back of the worst financial stress we have ever been in since the war because of the virus, couple that with the war in Ukraine, which of course we want to help with financially as well as importing goods from them and you have got a very serious problem.

I don't disagree, we all need a rise in wages, and businesses also need a boost but we can't have it all, inflation is a killer and the timing is just not right.

Ask anyone who lived through the 70s

Of course you are right mathematically. However if everyone gets an 11% pay rise then prices will go higher. That 11 % becomes devalued pretty quickly and the cycle continues. The short term gains of the pay award disappear. Far better to try to reduce demand and dampen inflation that way….or fix the supply side issues like Russia.

A striking frontline railway worker earning £40k, £50k, £60k, to me, is a totally different kettle of fish to a cleaner on crap pay working night shifts. With inflation at 9% (8.8% average in the EU btw) and rising, my sympathies are with low and lesser paid folk.

BBC R4, unrelated to this strike, have covered this. Inflation hits the poor hardest, as life’s essentials naturally comprise a larger chunk of their spending.

If we have a sustained spell of say 11% inflation, I’d like to see all employers and HMG specifically target those workers/households. Now.

Printing more money so that everyone gets inflation beating/equalling pay rises ad infinitum, as a matter of course, without improvements to productivity, will only exacerbate the inflationary cycle. Supply driven inflation will be augmented with 70’s style wages/prices inflation. People would’ve forgotten that anyone with savings (millions of pensioners) will see their real value plummet, anyone on a fixed income will become permanently poorer.

Many on here genuinely think people at lower pay ranges should be earning a lot more. Obviously this would have to come from somewhere. Do you think it should come from higher earners earning less or paying more tax. Do you think corporation tax should be increased.

The BoE has been printing money for over a decade, although they called it QE. They don't print money to pay salaries: it just means the government has to either raise more money through taxation to pay for it, cut spending elsewhere, or increase the deficit.

The BoE has been printing money for over a decade, although they called it QE. They don't print money to pay salaries: it just means the government has to either raise more money through taxation to pay for it, cut spending elsewhere, or increase the deficit.

The BoE has been printing money for over a decade, although they called it QE. They don't print money to pay salaries: it just means the government has to either raise more money through taxation to pay for it, cut spending elsewhere, or increase the deficit.

Many on here genuinely think people at lower pay ranges should be earning a lot more. Obviously this would have to come from somewhere. Do you think it should come from higher earners earning less or paying more tax. Do you think corporation tax should be increased.

After the billions spent on Covid now raging inflation I think it is completely irresponsible to go on strike now.

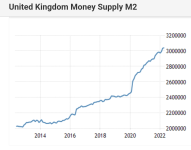

Quite. It's one of, arguably the main, cause of the current period of inflation, particularly as the 2020 pump didn't coincide with a period of increased output.

View attachment 149091

This government wrote off £10Bn of covid fraud without any kind of effort to retrieve it. That’s not the poor peoples fault

QE was started in massive way by Gordon Brown in 2008, but inflation only took off 14 years later in 2022.

QE was used to shore up bank capital and pay for furlough, not to finance a consumer boom.

QE was started in massive way by Gordon Brown in 2008, but inflation only took off 14 years later in 2022.

QE was used to shore up bank capital and pay for furlough, not to finance a consumer boom.

I'm really not an expert on this but isn't there a lag between QE and potential inflationary effects of that? Also, if you effectively print money you are 'debasing' it, is it not inevitable that inflation will result?

QE was started in massive way by Gordon Brown in 2008, but inflation only took off 14 years later in 2022.

QE was used to shore up bank capital and pay for furlough, not to finance a consumer boom.

giving money directly... so we're on handouts now? bit leap.

what do you think the mid and higher earners do with their money? all those cars, building work, holidays, iphones etc just appear do they? they dont go to the supermarket, hairdressers, pubs or restaurants? where is this absurd notion that only one group of people spend their money coming from?

I'm really not an expert on this but isn't there a lag between QE and potential inflationary effects of that? Also, if you effectively print money you are 'debasing' it, is it not inevitable that inflation will result?