- May 8, 2018

- 11,390

How many 1st time buyers pay £500,000 for a house. Typical rich knobs mini budget

Help to buy inner city innit

How many 1st time buyers pay £500,000 for a house. Typical rich knobs mini budget

How many 1st time buyers pay £500,000 for a house. Typical rich knobs mini budget

Everyone in London

Exactly, as the poster above said, Inner city budget

So everyone in London is inner city?

So how much Stamp Duty will I pay on £340000 now.

Not a first time buyer either.

TIA

Sent from my CPH2195 using Tapatalk

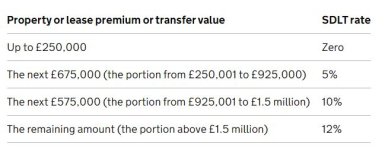

So have I got this right? I am completing on a £360K purchase (not first time buyer) next Friday, and now the threshold has been raised from 125K to 250K, based on the below I should save £2500 as the circled bit will disappear?

View attachment 152092

Everyone in London

)

)So how much Stamp Duty will I pay on £340000 now.

Not a first time buyer either.

TIA

Sent from my CPH2195 using Tapatalk

I think, like me (see above) you will save £2500

Yes good points.Depends what you class as normal levels, historically the mean is probably around 4%. Dropping back to normal levels is just what we're used to since the financial crash. Trouble is if other central banks raise rates and get their inflation under control, our currency loses value so it's not just about our own inflation.

The government are then countering the blunt instrument of interest rate rises with tax cuts and bail outs such as energy caps etc. so tackling inflation with one hand, but giving it back with another. It has the appearance of 2 competing stategies to me at least.

Crystal balls, fingers in the air = government strategy principles. [emoji38]ol:

What are people's views on how high interest rates will go in the next 12 months?

Officially into a recession today, albeit 0.1% contraction. Raising interest rates is exactly what you do not want to be doing in a recession, as it further dampens the economy and deepens the downturn. But I realise the BOE are grappling to get inflation under control, which is clearly the priority right now.

Surely they'll have to play a very fine balancing game though, I can't see them going over 3-3.5% at the peak? Potentially to drop when inflation is back down to normal levels, otherwise this recession will be long and deep.

Appreciate this is all crystal ball stuff.

So have I got this right? I am completing on a £360K purchase (not first time buyer) next Friday, and now the threshold has been raised from 125K to 250K, based on the below I should save £2500 as the circled bit will disappear?

View attachment 152092

Could be more than that as the bit above £250k might be at 2%, rather than 5%, or less if that bit is >5%...

Same I think, £7000

Yes I understand it now, I didnt realise they were taking away the 125k to 250k bracket.£ 4500

£ 90000 5%

I believe first £ 250000 is exempt of stamp duty now